|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Understanding the Best Refinance Rates for a 10 Year Fixed LoanRefinancing your mortgage with a 10-year fixed loan can be a smart financial move. This guide will help you navigate the process and find the best rates available. Why Choose a 10-Year Fixed Refinance?Opting for a 10-year fixed refinance can offer several advantages. It often comes with lower interest rates compared to longer terms, potentially saving you thousands in interest. Benefits of Shorter Loan Terms

How to Find the Best Refinance RatesFinding the best refinance rates involves comparing offers from different lenders and understanding the factors that affect rates. Factors Influencing Refinance Rates

For those considering unique situations, such as needing to refinance a house in foreclosure, specific guidance is crucial. Steps to Secure the Best RatesFollow these steps to ensure you get the best possible refinance rate. Improve Your Credit ScorePay off debts and avoid new credit inquiries to boost your score. Shop AroundCompare offers from multiple lenders to find competitive rates. Additionally, if you're looking to refinance your mobile home loan, specialized lenders may provide the best terms. FAQs About 10-Year Fixed Refinance RatesWhat is the average interest rate for a 10-year fixed refinance?The average rate can vary based on market conditions, but it generally ranges from 2% to 4%. How can I qualify for the best rates?Maintaining a high credit score, having a stable income, and a low debt-to-income ratio can improve your chances. Is it worth refinancing for a 10-year term?If you can afford higher monthly payments and wish to pay off your loan faster, it can be a beneficial choice. By understanding the process and taking strategic steps, you can successfully secure a favorable refinance rate for a 10-year fixed loan. https://www.zillow.com/mortgage-rates/10-year-fixed/

the rate was 5.709 percent,, and the annual percentage rate was 5.837 percent. https://www.bankrate.com/mortgages/10-year-refinance-rates/

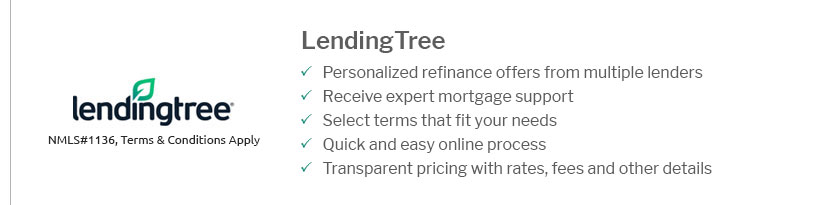

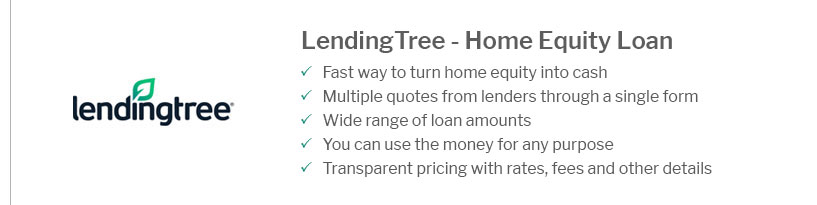

Compare current 10-year refinance rates ; Security Service Federal Credit Union. 10 year fixed refinance. Points: 0. 6.750%. 10 year fixed refinance. 6.771%. https://www.lendingtree.com/home/mortgage/10-year-mortgage-rates/

Current average rates are calculated using all conditional 10-year loan offers made from 8/01/2024 to 10/31/2024 and presented to consumers nationwide.

|

|---|